In capital budgeting, the payback period is defined as the amount of time necessary for a company to recoup the cost of an initial investment using the cash flows generated by an investment. When the negative cumulative discounted cash flows become positive, or recover, DPB occurs. The discounted payback period has a similar purpose as the payback period which is to determine how long it takes until an initial investment is amortized through the cash flows generated by this asset. Payback period doesn’t take into account money’s time value or cash flows beyond payback period.

Discounted Payback Period: Definition, Formula & Calculation

You first need to discount the cash flows for each year you expect to generate revenue from the project. You then add up the discounted cash flows to find the year in which your cash flow meets or exceeds the investment. The screenshot below shows that the time required to recover the initial $20 million cash outlay is estimated to be ~5.4 years under the discounted payback period method. In this example, the cumulative discountedcash flow does not turn positive at all.

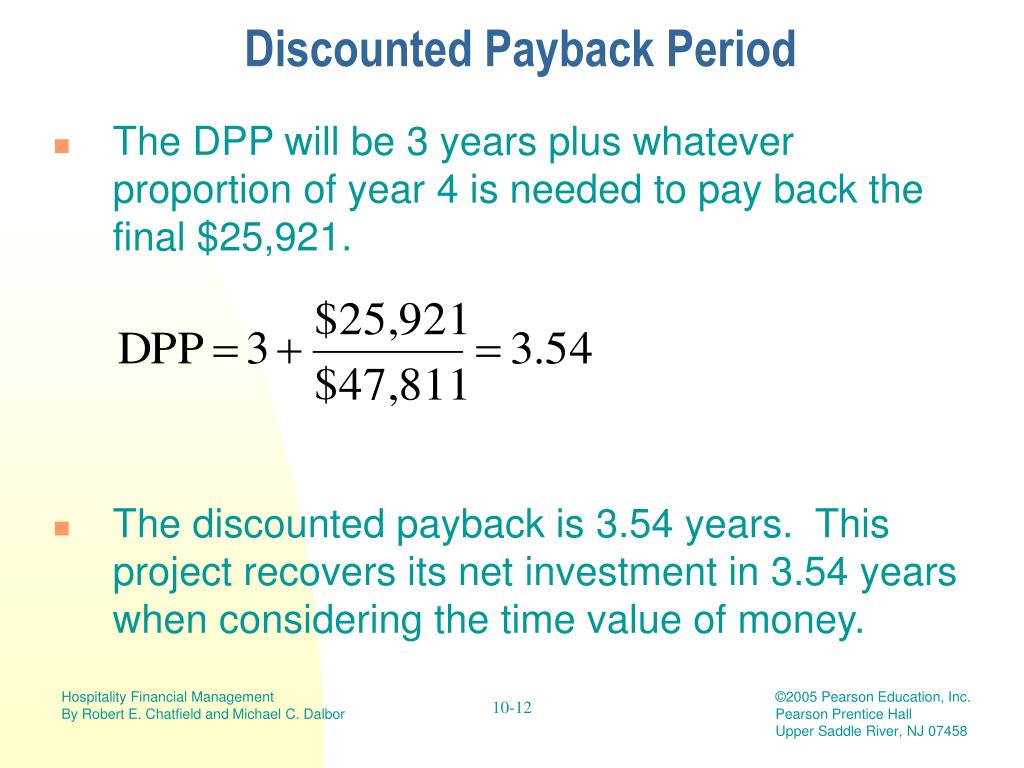

Examples of Applying the DPP

The calculator below helps you calculate the discounted payback period based on the amount you initially invest, the discount rate, and the number of years. DefinitionThe discounted payback is defined as the length of time it takes the discounted net cash revenue/cost savings of a project to payback the initial investment. It can be seen from the table that the cumulative cash flow becomes positive in year three. If cash flows arise at the end of the year, the payback period will be three years. Shorter discounted payback periods are better, as they indicate less risk and quicker recovery of investment costs.

Discounted Payback Period Calculation in Excel

This means that you would only invest in this project if you could get a return of 20% or more. Note that here an assumption is that the cash flows arise at the end of the year so the answer is a whole number of years. This last disadvantage will be overcome if the discounted payback is calculated rather than the payback period. You need to provide the two inputs of Cumulative cash flow in a year before recovery and Discounted cash flow in a year after recovery.

Unlike the standard payback period, the discounted payback period accounts for the time value of money, making it more accurate. Based on the project’s risk profile and the returns on comparable investments, the discount rate – i.e., the required rate of return – is assumed to be 10%. The payback period is favored when a company is under liquidity constraints because it can show how long it should take to recover the money laid out for the project. If short-term cash flows are a concern, a short payback period may be more attractive than a longer-term investment that has a higher NPV.

- In most cases, this is a pretty good payback period as experts say it can take as much as 7 to 10 years for residential homeowners in the United States to break even on their investment.

- Inflows are any items that go into the investment, such as deposits, dividends, or earnings.

- The payback period is a method commonly used by investors, financial professionals, and corporations to calculate investment returns.

- This is the idea that money is worth more today than the same amount in the future because of the earning potential of the present money.

This is not the same as the discounted payback period, where those cash flows are discounted back to their present value before the payback calculation is made. Because no discounting is applied to the basic payback calculation, it always returns a payback period that is shorter than what would be obtained with the discounted payback period calculation. Use this calculator to determine the DPP ofa series of cash flows of up to 6 periods.

The simple payback period doesn’t take into account money’s time value. The project has an initial investment of $1,000 and will generate annual cash flows of $200 for the next 5 years. These two calculations, although similar, may not return the same result due to the discounting of cash flows. For example, projects with higher cash flows toward the end of a project’s life will experience greater discounting due to compound interest. For this reason, the payback period may return a positive figure, while the discounted payback period returns a negative figure. According to discounted payback method, the initial investment would be recovered in 3.15 years which is slightly more than the management’s maximum desired payback period of 3 years.

Corporations and business managers also use the payback period to evaluate the relative favorability of potential projects in conjunction with tools like IRR or NPV. Although calculating the payback period is useful in financial and capital budgeting, this metric has applications in other industries. It can be used by homeowners and businesses to calculate the return on energy-efficient technologies such as solar panels and insulation, including maintenance and upgrades.

Based solely on the payback period method, the second project is a better investment if the company wants to prioritize recapturing its capital investment as quickly as possible. There are a variety of ways to calculate a return on investment (ROI) — net present value, internal rate of return, breakeven — but the simplest is payback period. An organisation is considering a project which has an initial investment of $40,000 and is expected to generate profit after depreciation but before tax of $12,500 each year for eight years. Depreciation will be on a straight line basis over the life of the project. From a capital budgeting perspective, this method is a much better method than a simple payback period. NPV calculates the total value that an investment adds to the firm, discounting those future cash flows to a present value.

The discounted payback period process is applied to each additional period’s cash inflow to find the point at which the inflows equal the outflows. At this point, the project’s initial cost has been credere definition and meaning paid off, with the payback period being reduced to zero. The shorter a discounted payback period is means the sooner a project or investment will generate cash flows to cover the initial cost.