Instead, the cost of merchandise purchased from suppliers is debited to the general ledger account Purchases. At the end of the accounting year the Inventory account is adjusted to the cost of the merchandise that is unsold. The remainder of the cost of goods available is reported on the income statement as the cost of goods sold.

FAR CPA Practice Questions: Journal Entries for Treasury Stock Transactions

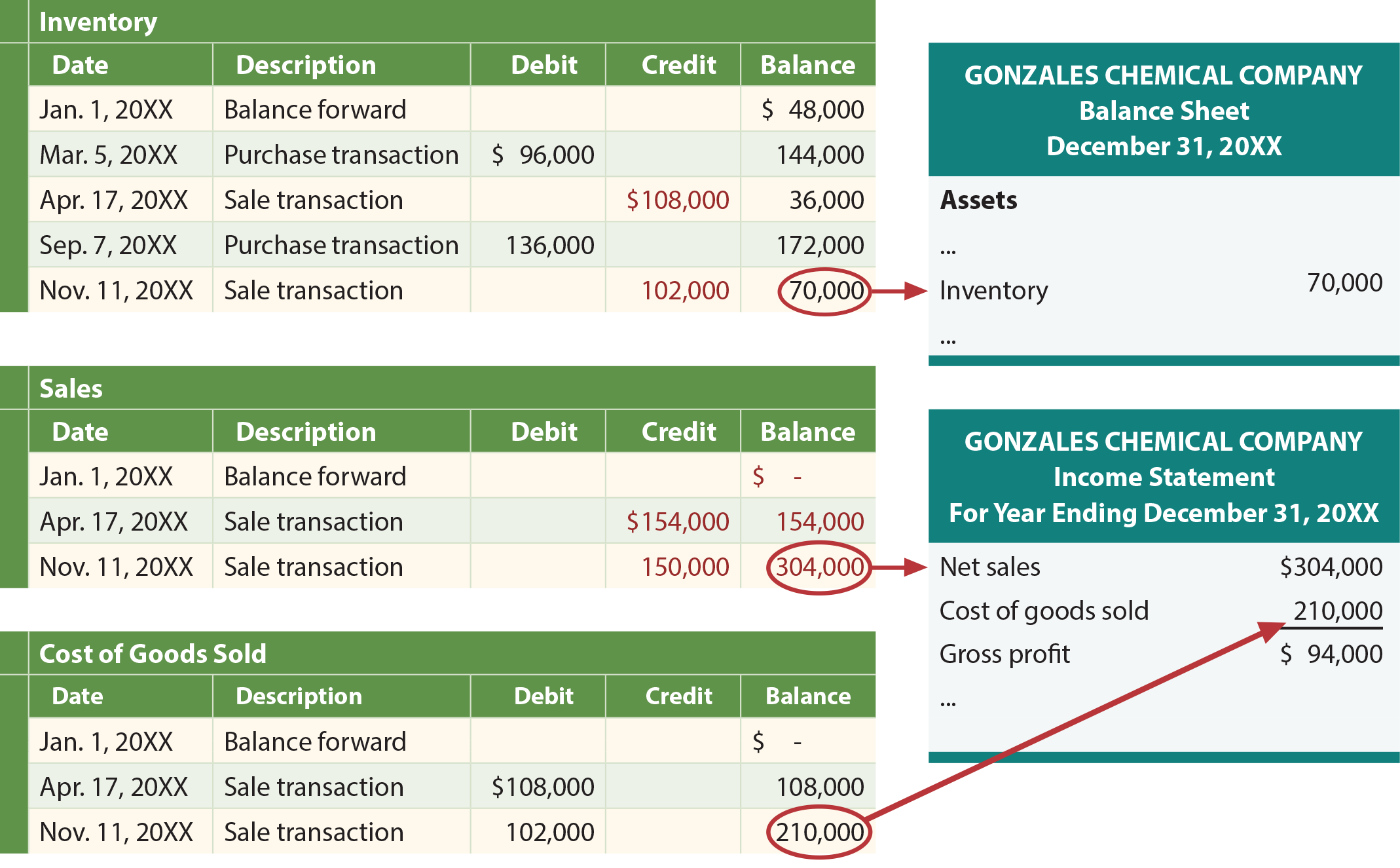

A perpetual inventory does not need to be adjusted manually by the company’s accountants, except to the extent that it deviates from the physical inventory count due to loss, breakage, or theft. When using the perpetual inventory system, the Inventory account is constantly (or perpetually) changing. With perpetual LIFO, the last costs available at the time of the sale are the first to be removed from the Inventory account and debited to the Cost of Goods Sold account.

- For instance, real-time inventory information is vital for the financial and accounting teams.

- They do not keep an inventory account in a periodic system since they debit all purchases to a purchase account.

- A physical inventory count requirescompanies to do a manual “stock-check” of inventory to make surewhat they have recorded on the books matches what they physicallyhave in stock.

- Businesses increasingly track inventory using a perpetual inventory system versus the older, physical-count periodic inventory system.

What is an example of a perpetual inventory system?

A periodic inventory system updates and recordsthe inventory account at certain, scheduled times at the end of anoperating cycle. The update and recognition could occur at the endof the month, quarter, and year. There is a gap between the sale orpurchase of inventory and when the inventory activity isrecognized. A periodic LIFO inventory system begins by computing the cost of ending inventory at the end of a period and then uses that figure to calculate cost of goods sold.

Perpetual Inventory System

It is far more sophisticated than the periodic system of inventory management. A perpetual inventory system is a program that continuously estimates your inventory based on your electronic records, not a physical inventory. This system starts with the baseline from a physical count and updates based on purchases made in and shipments made out. Perpetual inventory is a continuous accounting practice that records inventory changes in real-time, without the need for physical inventory, so the book inventory accurately shows the real stock.

Perpetual systems are costly to implement but less expensive and time-consuming over the long haul. Because perpetual inventory systems lack the ability to account for loss, breakage, or theft, a periodic (physical) inventory can still be necessary. Since businesses often carry products in the thousands, performing a physical count can be difficult and time-consuming. Imagine owning an office supply store and trying to count and record every ballpoint pen in stock. Changes in inventory are accurate (as long as there is no theft or damage to any goods) and can be easily accessed immediately.

What Is a Perpetual Inventory System?

A purchase return or allowance under perpetual inventory systemsupdates Merchandise Inventory for any decreased cost. Underperiodic inventory systems, a temporary account, Purchase Returnsand Allowances, is updated. Purchase Returns and Allowances is acontra account and is used to reduce Purchases. Many companies counter this with periodic partial inventory counts, which provide a baseline for the perpetual system and are designed to provide a full physical inventory by the end of the period. In a perpetual system, the inventory account changes with every transaction.

When you sell products in a perpetual inventory system, the expense account increases and grows the costs of sales. Also called the cost of goods sold (COGS), the costs of sales are the direct expenses from the production of goods during a period. These costs include the labour and materials costs but leave off any distribution or sales costs. Inventory management software and processes allow for real-time updating of the inventory count. Often, this means employees use barcode scanners to record sales, purchases or returns at the moment they happen.

A sales allowance and sales discount follow the same recordingformats for either perpetual or periodic inventory systems. When a sales return occurs, perpetual inventory systems requirerecognition of the inventory’s condition. Under periodicinventory systems, only the sales return is recognized, but not theinventory condition entry. This list makes it clear that the perpetual inventory system realized capital gains is vastly superior to the periodic inventory system. The primary case where a periodic system might make sense is when the amount of inventory is very small, and where you can visually review it without any particular need for more detailed inventory records. Businesses increasingly track inventory using a perpetual inventory system versus the older, physical-count periodic inventory system.

With perpetual inventory, overstatements, also called phantom inventory, and missing inventory understatements can be kept to a minimum. Perpetual inventory is also a requirement for companies that use a material requirement planning (MRP) system for production. The cost of sales would be determined according to the price of the last purchased items. Here, we’ll briefly discussthese additional closing entries and adjustments as they relate tothe perpetual inventory system. With the perpetual inventory system, the cost of goods sold is readily available in the account Cost of Goods Sold.