In each of these scenarios, differential cost analysis provides a clear picture of the financial impact of each decision, allowing businesses to navigate complex choices with a firm grasp of the potential costs and benefits. By focusing on the incremental changes, companies can make informed decisions that align with their financial goals and strategic direction. This analytical approach is not just about cutting costs but also about optimizing resources to achieve the best possible outcome for the business. It’s a dynamic tool that adapts to the ever-changing business environment, offering clarity amidst the financial complexities that modern businesses face.

By analyzing differential costs, companies can determine the incremental cost of producing additional units and set prices that cover these costs while also providing room for profit. This approach is not only about covering costs but also about strategic pricing that can influence market demand and competitive positioning. Differential cost analysis is a cornerstone of managerial accounting, providing a framework for businesses to make informed decisions by considering the costs that differ between alternative choices. This approach is particularly useful when assessing the financial implications of strategic decisions such as product pricing, outsourcing, and resource allocation. By focusing on the relevant costs, which are the costs that will change as a result of a decision, managers can disregard sunk costs and fixed costs that do not impact the decision-making process. The power of differential cost analysis lies in its ability to simplify complex financial landscapes into actionable insights, allowing businesses to navigate through the myriad of potential paths with confidence and clarity.

How does price discrimination work in differential pricing?

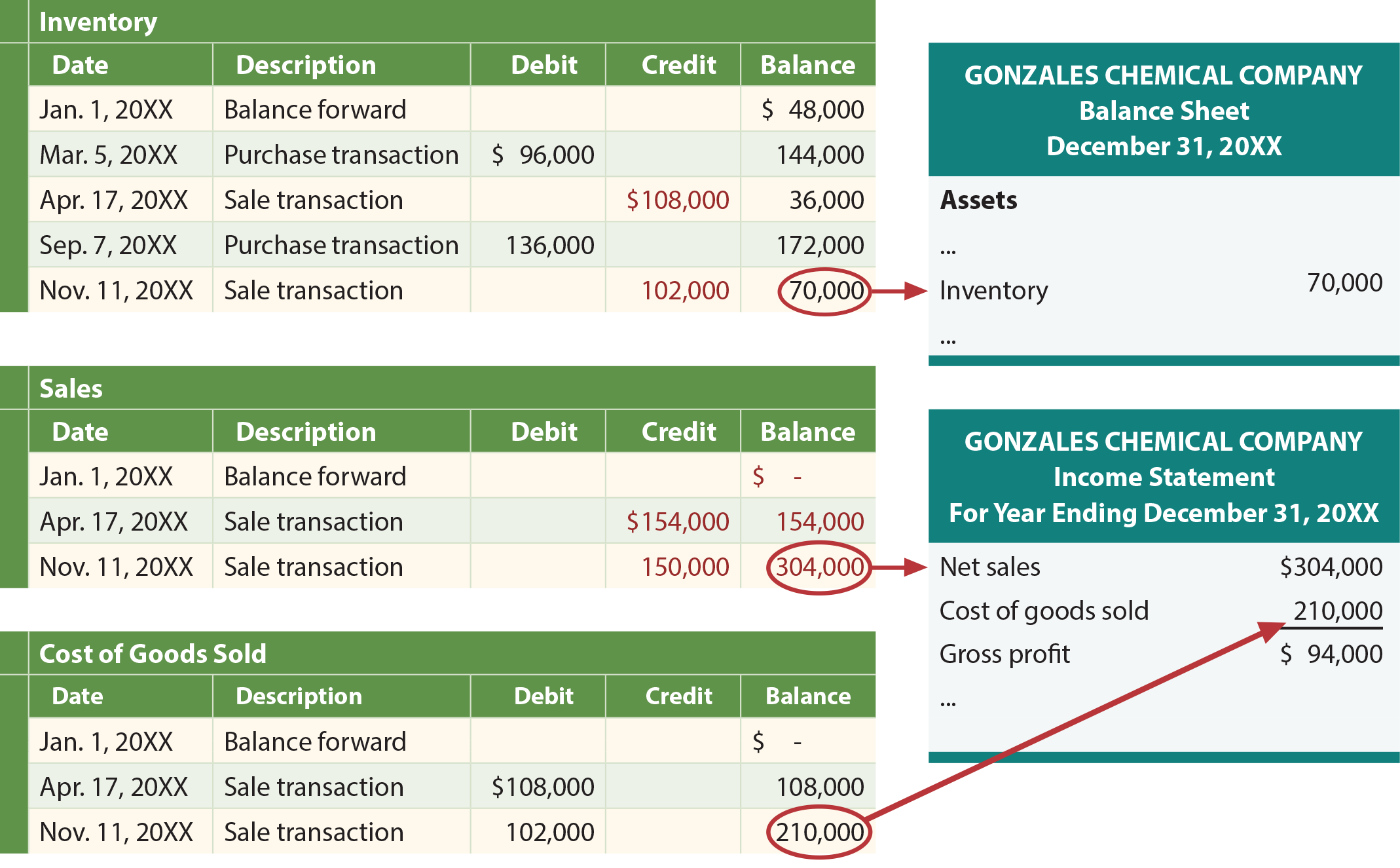

Analyzing differential costs helps in understanding the impact of various decisions on the overall business performance, enabling organizations to align their strategies with their goals. It also plays a crucial role in evaluating the trade-offs between different options, thereby guiding businesses towards the most economically advantageous course of action. From the perspective of a manufacturer, differential cost is essential when deciding whether to accept a special order at a lower price than usual. If the differential cost of producing the order is less than the price offered, it may be beneficial to accept the order to contribute to overall profitability.

For instance, a manufacturing plant may have a fixed monthly electricity charge plus additional costs that vary with production levels. Analyzing mixed costs can be more complex due to their dual nature, but it is essential for accurate differential cost analysis. By breaking down mixed costs into their fixed and variable components, businesses can better understand how these costs will change with different levels of activity and make more informed decisions. From the perspective of a production manager, differential costs are crucial when considering whether to add or remove a product line.

Terms Similar to Differential Cost

Differential cost refers to the difference in total costs between two alternatives, encompassing all relevant costs that change as a result of the decision. This broader perspective is useful for evaluating complex decisions where multiple cost factors are at play, such as choosing between different production methods or entering new markets. From the perspective of a CFO, differential cost analysis is a tool for steering the company away from potential financial pitfalls. It allows for a granular examination of how changing one variable can impact the overall cost structure, leading to more informed and strategic decisions.

Fixed Differential Cost

Set different prices based on price sensitivities and real-time price elasticity. Businesses analyze customer behavior and market trends to find the one price for each situation. If you’re not leveraging differential pricing, you may be missing out on serious revenue. Sunk cost is a cost that has already been incurred and cannot be recovered, while differential cost is a future cost that can be avoided by choosing a different option.

- Real-world applications illuminate the theory—consider how businesses determine the best route when faced with alternative choices in production or service delivery.

- The total cost figures are considered for differential costing and not the cost per unit.

- One of the primary components in differential cost analysis is the identification of relevant costs.

- Businesses also factor in market conditions that vary by location, allowing for a pricing model that’s highly flexible and personalized.

- Not always; companies also consider other factors like quality and impact on business before deciding.

Moreover, differential cost analysis can inform dynamic pricing strategies, where prices are adjusted based on real-time market conditions. For example, an airline might use differential cost analysis to set ticket prices based on factors such as fuel costs, demand patterns, and competitor pricing. By continuously monitoring and adjusting prices, the airline can maximize revenue while ensuring that its pricing remains competitive. This approach requires sophisticated data analysis tools and real-time cost tracking, but the potential benefits in terms of increased profitability and market responsiveness are substantial. Financial analysts, on the other hand, might use differential cost analysis to assess the viability of a new investment project. They would compare the expected incremental revenues against the incremental costs to determine if the project should proceed.

Comparing Differential Costs and Opportunity Costs

Businesses can implement a dynamic pricing strategy to predict demand fluctuations based on seasonal patterns or demand differential pricing. While differential cost analysis is a powerful tool, it requires careful consideration of a multitude of factors, some of which are not easily quantifiable. Decision-makers must approach this analysis with a critical eye and be prepared to adjust their models as new information becomes available. The key is to use differential cost analysis as a guide rather than a definitive answer, always considering the broader context in which the business operates. By integrating the consideration of differential costs into their decision-making processes, organizations can optimize resource allocation and improve their competitive positioning in the market.

- Differential costing involves the study of difference in costs between two alternatives and hence it is the study of these differences, and not the absolute items of cost, which is important.

- Each type has its own application, which can significantly enhance a company’s pricing strategy and boost revenue.

- Put simply, they tally up extra costs like materials, labor or shipping that come with each option.

- A company has a capacity of producing 1,00,000 units of a certain product in a month.

- This understanding is indispensable for devising effective cost reduction strategies, as it allows organizations to focus on the specific activities or resources that are the main contributors to cost variation.

- Think of your phone bill with its basic charge plus extra fees for additional data use.

A good tiered pricing model lets customers self-select based on value and need, while you capture more revenue across segments. Differential pricing isn’t just about tweaking numbers on a price tag—it’s about being smart, strategic, and a little bit empathetic. It’s like hosting a party where everyone gets their favorite drink at just the right time. Captures the highest revenue from each segment by adjusting prices strategically.

The differential cost would be the difference in the cost of producing the product in-house and the cost of outsourcing it. The unique characteristic of semi-variable costs lies in their ability to change in relation to the level of production or activity, making it difficult to accurately predict their behavior. This complexity introduces challenges in determining the appropriate cost drivers and developing effective cost reduction strategies. The identification of fixed differential costs helps in driving cost reduction initiatives, as it allows for a targeted approach towards minimizing these unchanging expenses, thereby improving overall cost efficiency.

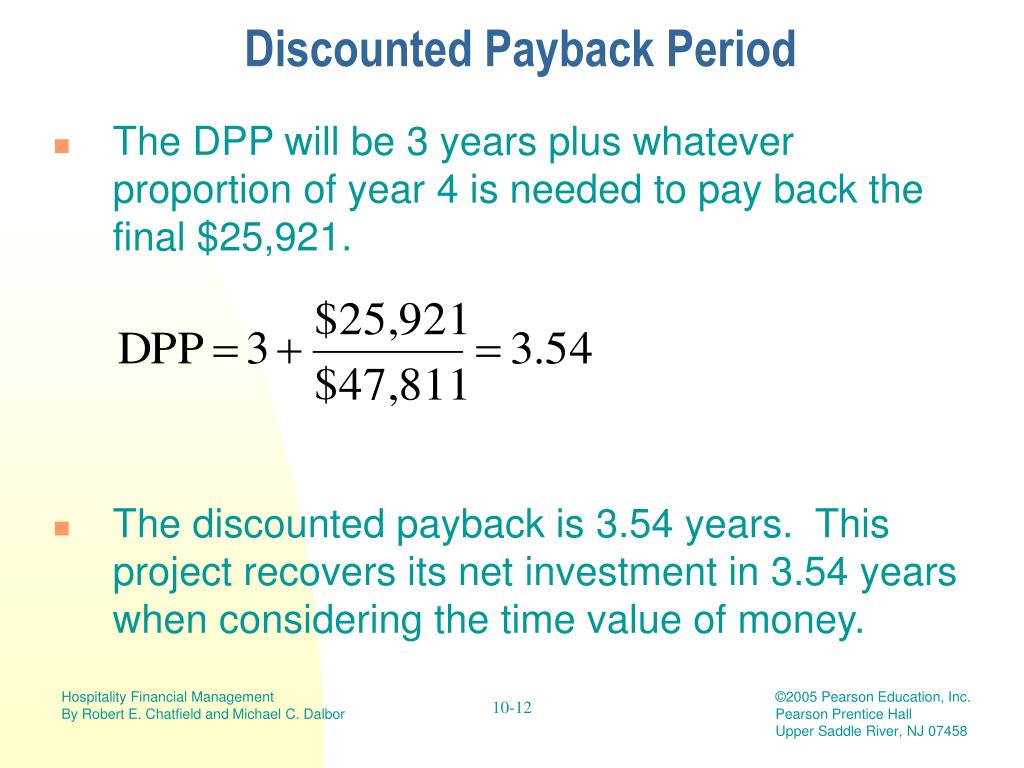

Differential costs play a significant role in making decisions about whether to proceed with a certain project. If the differential cost is less than the projected increase in income from a new project, the project might be a worthwhile investment. Differential cost refers to the difference in costs that arises when an organization decides to change business strategies or operational decisions.

Understanding and analyzing differential costs is not just about crunching numbers; it’s about strategic thinking and foresight. It involves considering various scenarios and their potential outcomes, assessing the opportunity costs, and aligning decisions with the overall business objectives. The strategic importance of differential cost analysis cannot be overstated in the context of modern business practices.

On the other hand, opportunity cost represents the benefits a business misses out on when choosing one alternative over another. It’s the cost of the foregone alternative, the «road not taken,» so to speak. Understanding the distinction tax software survey between differential cost and incremental cost is fundamental for effective financial decision-making. While both concepts involve analyzing changes in costs, they are applied in different contexts and serve unique purposes.