The variable cost function helps companies determine production volumes. In the above graph, X-axis represents the Units of Output and Y-axis represents the Fixed Cost. TFC is the fixed cost curve formed by plotting the points in the above schedule. The TFC curve makes an intercept with Y-axis equal to ₹10 Fixed Cost. It is a horizontal straight line parallel to the X-axis.

This calculation provides an evaluation of the overall expenditure incurred during the production process. By figuring out your total cost, you might see that you’re spending a lot more on using the gym than you initially thought. Therefore, you’ll now have to find a way to reduce your variable costs or go to a gym that includes all of these things in your membership fee. Your fixed cost would go up, but you would have no variable costs, keeping your total cost more consistent.

Total Cost Formula Examples: A Step-by-Step Calculation

If the price received is greater than the average variable cost and fixed costs, production should continue. But you should shut down production when the price is lower than the sum of average variable costs and fixed costs. In this section, we discuss how to calculate average variable costs.

TVC is the total variable cost curve formed by plotting the points in the above schedule. It can be seen in the above graph, the TVC curve starts from the origin, which means that at zero level of output, the variable cost is also zero. TVC is an inversely S-shaped curve because of the Law of Variable Proportion. The costs on which the output level does not have a total cost formula direct impact are known as Fixed Costs. For example, salary of staff, rent on office premises, interest on loans, etc.

Examine successful cost reduction strategies implemented by businesses to optimize total cost and enhance profitability. In the case of an individual, total cost can tell a person if the services he is using are worth it or if the cost of living is too high. When you realize the total cost you are spending on something, it may encourage you to make a lifestyle change to reduce some of those costs. In the short run, some of the factors are fixed, while other factors are variable.

How to find average variable cost?

This is why we’ve compiled this short guide to what the total cost formula is, the total variable cost vs total fixed cost, examples, and considerations. The formula for determining total cost involves fixed costs and variable costs. Fixed costs represent expenses that remain constant regardless of the production volume, such as rent, salaries, and insurance.

How to calculate the average variable cost?

This means that your total cost of using the gym for one month can actually be more than $100. The total fixed cost per calculator produced is GPB 25. The variable cost, depending on units sold and cost of the parts required is c. Use your profit and loss account for this and identify your total fixed costs. Rent expenses, salaries, insurance bills, equipment costs, and other business-related utilities are considered fixed costs.

Get business advice here

- Total Fixed Costs (TFC) are costs that occur independent from your production.

- Therefore, you’ll now have to find a way to reduce your variable costs or go to a gym that includes all of these things in your membership fee.

- To calculate total costs can be crucial in understanding your business’s profitability, which will help avoid financial difficulties and improve your business planning.

- Let informed predictions and powerful reporting guide your business.

A change in quantity is the increase or decrease in production level. The marginal cost function is derivative of the total cost function C(x). To find the marginal cost, derive the total cost function to find C’(x). The total fixed cost, fixed cost, supplementary cost, and overhead cost means the same.

Total Variable Costs (TVC) are costs that vary depending on production results. For example, raw material costs are directly affected by production. Total cost, on the other hand, is the cost resulting from the sum of the total fixed and variable costs. Total Cost (TC) is calculated by adding the two together.

In other words, variable cost is the cost spent on variable factors such as power, direct labour, raw material, etc. The amount spent on these factors changes with the change in output level. Also, these costs arise till there is production and become zero at zero output level. Companies must add fixed and variable costs to calculate the total cost for a product or service.

- Total cost represents the expenditure incurred when producing a product or rendering services.

- Explore strategies for effective asset management, including tracking, valuation & depreciation.

- It gives a clear and easily understood metric that can be measured and tracked to assess the profitability of a business.

- It has two components the fixed costs and variable costs.

- Incorrect total cost estimates can lead to pricing errors, financial losses, and poor strategic decisions, impacting overall business performance.

Common Challenges in Total Cost Calculation

Identifying your Total Cost can be crucial in understanding your business’s profitability. Learn how to properly evaluate your Total Cost performance. Logistics is undergoing a fundamental transformation. The popularity of direct-to-consumer (DTC) fulfillment models and ecommerce has increased pressure on third-party logistics (3PL) providers.

In the same way, the short-run costs are also categorised into two different kinds of cost; viz., Fixed Costs and Variable Costs. The sum total of these costs is equal to the Total Cost. The cost of production shows the functional relationship between output and cost involved in carrying out the production process. Total cost should be recalculated regularly, especially with changes in production processes, market dynamics, or external factors.

Learn how to manage cash flow in hospitality, forecast trends, and keep your business financially stable with smarter planning and real-time insights. Stay ahead of 2025 UK payroll legislation changes, including NIC, NMW, SSP & SMP updates. Understand the financial impact and ensure compliance.

It essentially allocates all costs incurred to the number of units produced over the measurement period. Calculating total cost is essential for companies to evaluate profitability, make pricing decisions, assess cost efficiency, and plan for future investments. It provides a holistic view of all expenses incurred in the production process, considering both fixed costs and variable costs.

]]>Journal entry for putting money into the petty cash fund

Taxi and other expenses will impact the income statement during the month while staff advance is presented as a current asset in the balance sheet. ABC is a consulting firm that provides services to other companies. In order to support the business activity, management decides to set up petty petty cash reimbursement journal entry cash of $ 5,000 to support the small and urgent payment.

The entry must show an increase in your Petty Cash account and a decrease in your Cash account. To show this, debit your Petty Cash account and credit your Cash account. Petty cash, or petty cash fund, is a small amount of cash your business keeps on hand to pay for smaller business expenses. These small amounts of cash can pay for low-cost expenses, like postage stamps or donuts for a meeting.

How to account for Petty Cash?

- It’s true that a large number of businesses still manage the petty cash funds, petty cash drawers, and sometimes petty cash registers.

- You would use your petty cash fund to reimburse your employee for the purchase of the supplies.

- Without a petty cash system, using small cash amounts periodically can add up to a major discrepancy in your books.

- Companies may also allocate petty cash budgets to various departments.

- By assigning the responsibility for the fund to one individual, the company has internal control over the cash in the fund.

At the end of the month, assume the $100 petty cash fund has a balance of $6.25 in actual cash (a five-dollar bill, a one-dollar bill, and a quarter). Frank, who is the responsible person, has been filling out the voucher during the month, and all the receipts are stapled to the voucher. During the accounting period, ABC Co. paid for various expenses from this account.

How large are petty cash funds?

- The most common uses of petty cash are making change for customers, reimbursing cash to employees for expenses they have made for business, or funding other small purchases.

- Your petty cash custodian determines if the expense is appropriate according to your business’s petty cash policy.Petty cash is considered a highly liquid asset.

- If the employee needs to spend more than the petty cash request limit, they can use the business credit card.

- To determine which accounts to debit, an employee summarizes the petty cash vouchers according to the reasons for expenditure.

Here is a video of the petty cash process and then we will review the steps in detail. Right after this entry has been recorded, the check cashed, and the proceeds put in the box, there will be $100 in the box again, an amount which will match the general ledger account. In fact, there is always $100 in the box if you add up all the receipts and the cash (more or less, depending on the cash over/short situation).

Many times businesses have to make small expenses instantaneously, and prior requisition is not possible. Similarly, a business can’t vouch and account for every small expense like a cup of coffee, taxi fare, smaller office supplies, etc. You can deduct some petty cash purchases from your business taxes if you have the proper records to support your claims.

You must debit your Postage, Meals and Entertainment, and Office Supplies accounts and credit your Petty Cash account. Like any other type of transaction, you must record petty cash transactions in your small business accounting books. For example, you might send an employee to pick up office supplies, like staples or printer paper.

Recording Petty Cash Expenses

Petty cash imprest funds are provided to enable departments to make cash conveniently available for minor business expenditures. Reimbursement for properly approved expenses may be obtained directly from the fund. Enter total reimbursement requested and accounting code information on a Check Request form. Documenting your Imprest account with receipts helps you to monitor how much money is being spent on incidental expenses, while also keeping you protected from employee fraud. If you’re looking for a simple way to keep track of your petty cash, an Imprest account could be ideal. A petty cash book is used for recording and tracking small purchases such as parking meter fees that aren’t suitable for check or credit card payments.

The most common uses of petty cash are making change for customers, reimbursing cash to employees for expenses they have made for business, or funding other small purchases. These are some commonly asked questions about the petty cash funds of a company. It’s true that a large number of businesses still manage the petty cash funds, petty cash drawers, and sometimes petty cash registers. You must document each expense if you want to deduct it from your business taxes. If you don’t document your petty cash purchases, you will not be able to deduct the expenses when you pay business taxes.

In most cases, companies include petty cash account balances under cash in hand. One of these includes limiting the amount of money they hold in the petty cash system. Usually, companies use the imprest system to handle their petty cash funds. Companies maintain a petty cash system to handle any money kept on hand. Before discussing its accounting, it is crucial to understand the concept first.

Types of Financial Information (Explained)

The petty cash may be use to purchase small assets and staff advances, so the entry will not impact the expense but other assets. The accountant can make journal entry by debiting assets or staff advances and credit petty cash. Change Funds are established for the sole purpose of making change for customer sales. The authorized amount of the fund should not exceed what is needed to support cash drawer activity. The Controller’s Office will conduct training sessions on the operation of Petty Cash funds by request as needed and for all new custodians.

And, you must record a petty cash journal entry when you put money into the petty cash fund and when money leaves the fund. Consider recording petty cash transactions in your books at least once per month. One of the conveniences of the petty cash fund is that payments from the fund require no journal entries at the time of payment. Thus, using a petty cash fund avoids the need for making many entries for small amounts. Only when the fund is reimbursed, or when the end of the accounting period arrives, does the firm make an entry in the journal.

Not rigorous, but budgeting is required for petty cash funds like any other item or account of the business entity. It can be done by studying past patterns and cash expenses help in setting an appropriate limit of cash balance in the company. The budgeting process includes setting a limit for monthly petty cash funds necessary for the company’s contingencies. After the recording of petty cash usage, the petty cash balance will decrease. Accountants need to reimburse the petty cash to float the balance.

]]>- Just finding the difference, though, will yield a mix of positive and negative values.

- During the process of finding the relation between two variables, the trend of outcomes are estimated quantitatively.

- The least squares method is used in a wide variety of fields, including finance and investing.

- From this equation, we can determine not only the coefficients, but also the approximated values in statistic.

- This same process implements a discrete Fourier transform when the data are uniformly spaced in time and the frequencies chosen correspond to integer numbers of cycles over the finite data record.

- Source code that implements this technique is available.24Because data are often not sampled at uniformly spaced discrete times, this method «grids» the data by sparsely filling a time series array at the sample times.

In 1805 the French mathematician Adrien-Marie Legendre published the first known recommendation to use the line that minimizes the sum of the squares of these deviations—i.e., the modern least squares method. The German mathematician Carl Friedrich Gauss, who may have used the same method previously, contributed important computational and theoretical advances. The method of least squares is now widely used for fitting lines and curves to scatterplots (discrete sets of data). This method, the method of least squares, finds values of the intercept and slope coefficient that minimize the sum of the squared errors. Traders and analysts have a number of tools available to help make predictions about the future performance of the markets and economy.

ystems of Linear Equations: Algebra

Moreover, as a Fourier-based method, LSFF does not possess the time–frequency analysis capabilities intrinsic to wavelet-based approaches like EWF. These limitations should be considered when selecting the most appropriate method for specific applications. The plot shows actual data (blue) and the fitted OLS regression line (red), demonstrating a good fit of the model to the data. Let’s walk through a practical example of how the least squares method works for linear regression.

Example: Predicting Plant Height Based on Sun Exposure

Since it is the minimum value of the sum of squares of errors, it is also known as “variance,” and the term “least squares” is also used. If the data shows a lean relationship between two variables, it results in a least-squares regression line. This minimizes the vertical distance from the data points to the regression line. The term least squares is used because it is the smallest sum of squares of errors, which is also called the variance.

Subsection6.5.1Least-Squares Solutions

The least squares method can be categorized into linear and invoice online or on the go nonlinear forms, depending on the relationship between the model parameters and the observed data. The method was first proposed by Adrien-Marie Legendre in 1805 and further developed by Carl Friedrich Gauss. The method of regression analysis begins with plotting the data points on the x and y-axis of the graph.

In other words, the Least Square Method is also the process of finding the curve that is best fit for data points through reduction of the sum of squares of the offset points from the curve. During finding the relation between variables, the outcome can be quantitatively estimated, and this process is known as regression analysis. The Least Square Method is a mathematical regression analysis used to determine the best fit for processing data while providing a visual demonstration of the relation between the data points.

Question1: Linear Least-Square Example

Traders and analysts can use this as a tool to pinpoint bullish and bearish trends in the market along with potential trading opportunities. The best fit result is assumed to reduce the sum of squared errors or residuals which are stated to be the differences between the observed or experimental value and corresponding fitted value given in the model. Source code that implements this technique is available.24Because data are often not sampled at uniformly spaced discrete times, this method «grids» the data by sparsely filling a time series array at the sample times. All intervening grid points receive zero statistical weight, equivalent to having infinite error bars at times between samples.

That is, it is a way to determine the line of best fit for a set of data. Each point of data represents the relationship between a known independent variable and an unknown dependent variable. Least square method is the process of finding a regression line or best-fitted line for any data set that is described by an equation. This method requires reducing the sum of the squares of the residual parts of the points from the curve or line and the trend of outcomes is found quantitatively. The method of curve fitting is seen while regression analysis and the fitting equations to derive the curve is the least square method.

Vedantu — (Bag + Bottle + Coffee Mug) & (Set of 6 Notebooks, Highlighter Set, Set of 4 Pens)

In such cases, when independent variable errors are non-negligible, the models are subjected to measurement errors. Therefore, here, the least square method may even lead to hypothesis testing, where parameter estimates and confidence intervals are taken into consideration due to the presence of errors occurring in the independent variables. The least-square method states that the curve that best fits a given set of observations, is said to be a curve having a minimum sum of the squared residuals (or deviations or errors) from the given data points. Let us assume that the given points of data are (x1, y1), (x2, y2), (x3, y3), …, (xn, yn) in which all x’s are independent variables, while all y’s are dependent ones.

- In other words, \(A\hat x\) is the vector whose entries are the values of \(f\) evaluated on the points \((x,y)\) we specified in our data table, and \(b\) is the vector whose entries are the desired values of \(f\) evaluated at those points.

- The least squares method is a form of regression analysis that provides the overall rationale for the placement of the line of best fit among the data points being studied.

- The error term ϵ accounts for random variation, as real data often includes measurement errors or other unaccounted factors.

- This analysis could help the investor predict the degree to which the stock’s price would likely rise or fall for any given increase or decrease in the price of gold.

- A student wants to estimate his grade for spending 2.3 hours on an assignment.

The least squares method is used in a wide variety of fields, including finance and investing. For financial analysts, the method can help quantify the relationship between two or more variables, such as a stock’s share price and its earnings per share (EPS). By performing this type of analysis, average accounts receivable calculation investors often try to predict the future behavior of stock prices or other factors. Equations from the line of best fit may be determined by computer software models, which include a summary of outputs for analysis, where the coefficients and summary outputs explain the dependence of the variables being tested. In order to find the best-fit line, we try to solve the above equations in the unknowns M and B.

The data points are minimized through the method of reducing offsets of each data point from the line. The vertical offsets are used in polynomial, hyperplane and surface problems while horizontal offsets are used in common problems. It is just required to find the sums from the slope and intercept equations. Next, find the difference between the actual value and the predicted value for each line. Then, square these differences and total them for the respective lines.

The two basic categories of least-square problems are ordinary or linear least squares and nonlinear least squares. So, when we square each of those errors and add them all up, the total is as small as possible. Proposed the key idea, designed and conducted the experiments, and wrote the manuscript. The GNSS position time series of 27 stations accounting for startups: the ultimate guide are provided by the China Earthquake Administration and are available upon reasonable request from the corresponding authors. The blue spots are the data, the green spots are the estimated nonpolynomial function.

The data points need to be minimized by the method of reducing residuals of each point from the line. Vertical is mostly used in polynomials and hyperplane problems while perpendicular is used in general as seen in the image below. In that case, a central limit theorem often nonetheless implies that the parameter estimates will be approximately normally distributed so long as the sample is reasonably large. For this reason, given the important property that the error mean is independent of the independent variables, the distribution of the error term is not an important issue in regression analysis. Specifically, it is not typically important whether the error term follows a normal distribution. One key strength is its robustness to missing data, as LSFF avoids the issue of negative covariance matrices in trajectory matrices, which can arise in ESSA under conditions of high data sparsity.

]]>We also offer customizable solutions like mobile apps and websites for your properties. Our continued innovation wouldn’t be possible without feedback from our clients. Our solutions increase efficiency and reduce costs for a global client base of public, private and nonprofit organisations. Markets we serve include commercial office, retail, industrial and logistics, residential, build to rent and student, coworking, airports and ports.

More how to calculate payroll taxes sophisticated implementations can take months to ensure all your needs are met. Join thousands of businesses worldwide that choose Yardi property management software and services to optimise every aspect of their operations. Automate calculations and produce results for timely and accurate reporting.

Since then, Yardi has grown dramatically to become the leading provider of software solutions for the real estate industry. As an integral part of the global communities in which we operate, Yardi contributes volunteer time and financial support to organisations dedicated to housing, health services, disaster recovery and other humanitarian services. Real estate investment management is available for any size organization, with any financial and ownership structures. As an integral part of the global communities in which we operate, Yardi contributes volunteer time and financial support to organizations dedicated to housing, health services, disaster recovery and other humanitarian services. Users suggest taking the time to carefully plan and configure Yardi during the initial setup phase. By doing so, businesses can ensure that the system is customized to meet their specific needs and requirements, which will ultimately lead to a smoother and more efficient operation.

- Yardi software and service solutions range in price depending on the product, market and portfolio.

- Day-to-day operations are intimately tied to asset value and investment performance.

- Once defined, the system automates calculations and accounting related to your business terms.

- On G2, the platform has a 3.9-star rating based on more than 190 reviews.

- It can also be connected to Yardi Investment Manager for internal stakeholder access to investor/investment data and for ease of communication with current and prospective investors.

- However, a handful of reviewers mentioned receiving unhelpful customer support and experiencing frequent technical difficulties on the website.

Day-to-day operations are intimately tied to asset value and investment performance. Our solutions help attract and retain occupants with advanced marketing and online services, for example. Electronic billing significantly cuts the cost of collecting and processing rents. Our award-winning energy management systems reduce HVAC costs and ensure regulatory compliance without reducing comfort.

Yardi Breeze

Markets we serve include commercial, multifamily, single family housing, self storage, student housing, senior housing, coworking, affordable housing, PHA, military housing, airports and parks and recreation. Dotloop is presented by the vendor as an all-in-one real estate transaction management solution that gives brokers and teams full visibility into their business and empowers agents to close deals. On G2, the platform has a 3.9-star rating based on more than 190 reviews. Many users were satisfied with its ease of use and comprehensive accounting services. However, a handful of reviewers mentioned receiving unhelpful customer support and experiencing frequent technical difficulties on the website. On TrustRadius, Yardi has a 7.7-star rating based on more than 70 reviews.

Yardi — Combining Property Management Functions

It can also be connected to Yardi Investment Manager for internal stakeholder access to investor/investment data and for ease of communication with current and prospective investors. For managing debt investments, integrate with Yardi Debt Manager to provide the same level of transparency from investor to borrower. Yardi software and service solutions range in price depending on the product, market and portfolio. Because our offerings are designed to increase revenue and reduce expenses, many clients find that they quickly offset any implementation costs and even pay for themselves. Designed to increase revenue and reduce expenses, many clients find that our offerings pay for themselves. While Yardi and Buildium both offer property accounting and tenant communication, each has its own standout features.

Multiple platforms to meet your property management software needs

Compare your portfolio investment performance to industry or internal benchmarks. Streamline the submission process for contributing members for key industry benchmarks. Join thousands of businesses worldwide that choose Yardi property management software and services to optimize every aspect of their operations. Breeze is a refreshingly simple property management system that works for residential, commercial, affordable housing, manufactured housing, self storage and inflation accounting in the system of modern accounting associations. You can get started using Breeze in just a day, no advanced training or experience required. Our client services team assists with implementation and provides in-person support and online training at every stage of the client’s product experience.

Pricing:

The best property management software maximizes efficiency, convenience and ROI for property managers, occupants and investors. Yardi software produces these outcomes by automating business processes, consolidating data and enabling execution of all operations from a single platform. Whatever your reasons for researching property management software, we’re here to help with a guide that includes everything you need to make a smart decision a little more quickly. Choosing the right property management software to organize, optimize and grow your business is a big decision, but it shouldn’t be overwhelming. Use the property management software how do i start a nonprofit organization checklist to help you make the right decision when reviewing the solutions available to you from any real estate technology provider. Connect to Yardi Voyager property management to automate all transactions and reporting from investor to lease.

]]>Premier may be a high price point for small businesses with more than one user, however, this is a perfect solution for bookkeepers who do accounting services for multiple companies. QuickBooks Premier best serves businesses with industry-specific requirements or high-volume inventory. In other words, industries such as retail, manufacturing, healthcare, and construction. Premier features consist of industry-specific information, job cost estimates, forecasting reports, and budgeting tools. A cash flow statement shows how changes in your income and overall balance sheet affect your liquidity at the moment represented by your cash and cash equivalents. On this statement, you’ll see financials broken down by operations, investments, and financing.

QuickBooks Online allows you to create invoices and either print them or email them to customers. You can create a new invoice from scratch or by converting an existing estimate into an invoice. The program is known for its customizable invoices—making it our overall best invoicing software. You can upload your company how to start an internet dating site logo, select from different templates, change the invoice colors, edit invoice fields, and add personalized messages for customers.

Simplify taxes

However, QuickBooks has made this capital budgeting: what it is and how it works task easy by providing tools for invoice creation, sending, and tracking all in one place. Expense Tracking and ManagementThe capacity for tracking and managing expenses is among QuickBooks’s most vital characteristics. When you are aware of where your money goes, you can manage your costs, thereby increasing profit.

An Affordable Bookkeeping Alternative to a CFO

With QuickBooks, one can handle payroll even with hundreds of workers or fewer but manage to do it precisely. This blog outlines 5 basic QuickBooks functions every owner should understand. These attributes are extremely helpful in managing business finances more effectively. This allows tailoring reports to your specific business intelligence needs.

However, automatic bill tracking does not mean you cannot do that manually. You can directly record a manual transaction easily, whether propeller industries email format in cash or check. Yes, QuickBooks is designed to be user-friendly and accessible, even for those without an accounting background. Evaluate your business’ specific needs when choosing the right QuickBooks product.

- This simplifies international business for companies buying and selling abroad.

- We’re a headhunter agency that connects US businesses with elite LATAM professionals who integrate seamlessly as remote team members — aligned to US time zones, cutting overhead by 70%.

- He has a CPA license in the Philippines and a BS in Accountancy graduate at Silliman University.

- The intuitive interface makes financial management easier for non-accounting users.

- This blog outlines 5 basic QuickBooks functions every owner should understand.

- Generate month-over-month reports and year-end financial reports to track the growth of your small business.

Best Small Business Accounting Software in 2024

Such reports as Profit & Loss (P&L) statements and balance sheets enable one to monitor his/her business performance on an instant basis. They can help management decide on cost cuts, profit maximization, and growth plans. With robust accounting tools, scalable online access, and easy integration with other business systems, QuickBooks empowers small businesses to efficiently manage their finances. Currently, QuickBooks is offering two different specials; you can either try it free for 30 days or sign up and get a 50% discount on your first three months. Again, QuickBooks has many reports available to analyze your bills and expenses.

How to Use Features and Functions in QuickBooks Online

Create professional invoices, track payments, and get paid faster. By automatically connecting bank/credit accounts and syncing transactions, QBO reduces manual data entry. Features like autofill and memorized transactions also automate repetitive tasks. It works best for small companies that need to organize their finances but don’t necessarily have large or complex accounting needs. The intuitive interface makes financial management easier for non-accounting users. Though a mainstay of the QuickBooks experience for decades, QuickBooks will no longer fully support QB Desktop in 2023, with the software’s complete migration to QuickBooks Online.

]]>During economic downturns, these businesses may struggle to cover their substantial fixed costs. The DOL is calculated by dividing the contribution margin by the operating margin. For example, the DOL in Year 2 comes out 2.3x after dividing 22.5% (the change in operating income from Year 1 to Year 2) by 10.0% (the change in revenue from Year 1 to Year 2).

This suggests that the company’s earnings before interest and taxes (EBIT) are highly sensitive to changes in sales. When sales increase, a company with high operating leverage can see significant boosts in operating income due to the fixed nature of its costs. Conversely, if sales decline, the company still needs to cover substantial fixed costs, which can significantly hurt profitability. The degree of operating leverage (DOL) is a multiple that measures how much the operating income of a company will change in response to a change in sales.

Date: June 28-29, 2025

Date: June 28-29, 2025 Time: 8:30-11:30 AM EST

Time: 8:30-11:30 AM EST Venue: OnlineInstructor: Dheeraj Vaidya, CFA, FRM

Venue: OnlineInstructor: Dheeraj Vaidya, CFA, FRM

A higher DOL means that the company is more leveraged, meaning small changes in sales will lead to larger changes in EBIT. As a business owner or manager, it is important to be aware of the company’s cost structure and how changes in revenue will impact earnings. Additionally, investors should also keep an eye on this ratio when considering an investment in a company.

Analysis and Interpretation

A higher contribution margin allows more revenue to cover fixed costs and increase operating income. For example, if sales rise by 20%, variable costs will increase proportionally, but the overall effect on operating income depends on the contribution margin. Companies with relatively low variable costs can achieve higher operating leverage and benefit more from sales increases. A high DOL indicates that a company has a larger proportion of fixed costs compared to variable costs.

Stocky’s may want to look into ways they can cut production costs—and potentially increase fixed costs—so they can see higher revenue gains from their sales. Or Stocky’s may be pleased with their leverage and believe Wahoo’s is carrying too much risk. With the operating leverage formula in hand, a company can see how different kinds of expenses impact their operating income. But once companies have this information…what can they do with it? Although revenues increase year-over-year, operating income decreases, so the degree of operating leverage is negative.

- A high DOL can be good if a company is expecting an increase in sales, as it will lead to a corresponding operating income increase.

- As the cost accountant in charge of setting product pricing, you are analyzing ABC Company’s fixed and variable costs and want to look at the degree of operating leverage.

- DOL helps investors assess the potential risks and rewards of a company’s cost structure, giving insights into how changes in sales might impact profitability.

- By calculating DOL, business owners, managers, and financial analysts can make more informed decisions regarding pricing, cost management, and risk strategies.

- Similarly, we can conclude the same by realizing how little the operating leverage ratio is, at only 0.02.

Operating leverage is the most authentic way of analyzing the cost structure of any business. By calculating your DOL and comparing it with industry benchmarks, you can assess your business’s efficiency and competitiveness. A DOL higher or lower than industry standards can indicate areas for improvement or potential strengths. When planning for business growth or expansion, knowing your DOL is crucial. A high DOL implies higher risk but also the potential for greater returns.

Degree of operating leverage closely relates to the concept of financial leverage, which is a key driver of shareholder value. Undoubtedly, the degree of financial leverage can guide investors in investment decisions. Undoubtedly, the company benefits in the short run from high operating leverages in most cases. But at the same time, such firms are exposed to fluctuations in economic conditions and business cycles. Investors can access a company’s risk profile by analyzing the degree of operating leverage. One thing that often gets ignored is the cost structure of a firm.

How to Calculate Degree of Operating Leverage?

If sales revenues decrease, operating income will decrease at a much larger rate. DOL is an important ratio to consider when making investment decisions. It measures a company’s sensitivity to sales changes of operating income.

Step-by-Step Example of DOL Calculation

The DOL would be 2.0x, which implies that if revenue were to increase by 5.0%, operating income is anticipated to increase by 10.0%. As a hypothetical example, say Company X has $500,000 in sales in year one and $600,000 in sales in year two. In year one, the company’s operating expenses were $150,000, while in year two, the operating expenses were $175,000.

- Use the calculator to pinpoint cost control opportunities and streamline your operations.

- These costs impact the contribution margin—the revenue remaining after variable costs are deducted.

- But once companies have this information…what can they do with it?

Companies with a large proportion of fixed costs (or costs that don’t change with production) to variable costs (costs that change with production volume) have higher levels of operating leverage. The Degree of Operating Leverage (DOL) measures how a company’s operating income responds to changes in sales. It provides insight into the relationship between fixed and variable costs and their impact on profitability. High DOL indicates that a small percentage change in sales can lead to a significant change in operating income.

The more fixed costs there are, the more sales a company must generate in order to reach its break-even point, which is when a company’s revenue is equivalent to the sum of its total costs. Financial and operating leverage are two of the most critical leverages for a business. Besides, they are related because earnings from operations can be boosted by financing; meanwhile, debt will eventually be paid back by those increased earnings. Thus, investors need to measure the impact of both kinds of leverages. In most cases, you will have the percentage change of sales and EBIT directly. The company usually provides those values on the quarterly and yearly earnings calls.

We can say that it is the sales’ impact on the company’s earnings. In other words, the numerical value of this ratio shows how susceptible the company’s earnings before interest and taxes are to its sales. If a company expects an increase in sales, a high degree of operating leverage will lead to a corresponding operating income increase. taxable income But if a company is expecting a sales decrease, a high degree of operating leverage will lead to an operating income decrease. The financial leverage ratio divides the % change in sales by the % change in earnings per share (EPS).

Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts. For comparability, we’ll now take a look at a consulting firm with a low DOL. Later on, the vast majority of expenses are going to be maintenance-related (i.e., replacements and minor updates) because the core infrastructure has already been set up. The catch behind having a higher DOL is that for the company to receive positive benefits, its revenue must be recurring and non-cyclical. We will need to get the EBIT and the USD sales for the two consecutive periods we want to analyze. In this case, it will be the 1st quarter, 2020 and the2nd quarter, 2020.

]]>Tanda is the ideal payroll system that can record workforce data accurately while catering to business growth and expansion. The seamless integration to Xero has earned A2X a Featured App as well as one of Xero’s Top Picks. With 175 reviews and a consistent 5 star rating over at Xero marketplace, A2X can do no wrong in helping online retailers and merchants streamline their back office to enjoy online business growth and success. By connecting DEAR Inventory in Xero, all inventory-related purchases, sales and manufacturing data will synchronise over to Xero. Invoices, bills and journal entries can then be created automatically from Xero, helping businesses save time and increase productivity. Solve your business challenges with certified software in the Xero App Store.

Payment processing fees are also recorded as an expense, which will be a time saver during tax time. With one click, the Tanda-Xero integration imports timesheets directly to the Xero payroll. The stress that usually comes with the payroll process is reduced.

Easily find the right apps for the job

Sophisticated analytics have been introduced to support app developers to improve their offerings. We’ve made a number of changes to the design layout of the storefront to make it easier to navigate and find the right apps to solve your business’ unique challenges. Yes, the Xero App Store has hundreds of apps to help manage your business, including apps specifically designed for your industry and for doing business in the USA. Easy-to-use accounting software, designed for your small business. When you connect apps to Xero the data flows between the tools – so changes you make in the app are reflected in Xero and vice-versa.

Accounting software

- The new Xero App Store makes it possible to start a trial and securely purchase apps in just a few clicks, all using your single Xero login.

- Fulfilling timely pay runs is crucial for a business, but can be stressful, especially when workforces are a mix of permanent, part-time and casual staff.

- Sophisticated analytics have been introduced to support app developers to improve their offerings.

- Encourage faster payments from your customers with apps that make settling the bill simple.

Xero apps are designed to solve specific business challenges. Connect apps for billing, expenses, CRM, document management, ecommerce, Loans, financing, and credit, inventory, invoicing, job management, payments, payroll, HR, point of sale, reporting, and time-tracking. Choose from apps for specific industries – like retail, hospitality, and construction. Or find apps for particular tasks and processes, such as inventory, job, project and, staff management. Xero’s searchable app store makes solving business challenges simple. Tanda manages rostering, timesheets and pay rates of every staff member, freeing up business owners from menial administrative tasks.

Gusto saves you time on all aspects of your payroll – including calculating employee pay and deductions – thanks to its clever automations. Strong, lasting relationships are a key element to business success. With each business relationship unique and constantly changing, keeping interactions flowing and consistent can be a juggle.

PayPal

DEAR Inventory is a centralised order and inventory management that controls app marketplace xero and manages products, customers, suppliers, purchases and sales. Its efficient inventory management can help identify consumer demands and potential growth areas. These are the core Xero mobile apps that help business owners and managers run their business and stay productive while out of the office. We believe this new customer experience will help make Xero an even stronger small business platform for our customers.

All kinds of apps for small businesses

It also provides that vital ‘match-making’ function for our app developer partners to better access the Xero customer base, and create new opportunities for their business to grow. Xero’s accounting software has flexible plans so you can adjust your subscriptions to access the features you need as your business grows. Find apps by searching by industry (such as retail) or business function (like payments). Many apps offer free trials where you can test the software before you buy, and Xero has plenty of resources to help you choose the right apps for your business. The Xero App Store is available at apps.xero.com and delivers on Xero’s aspiration for more customers to access and benefit from the power of Xero connected apps. Yet, a lot of small businesses still aren’t making the most of apps.

Apps are organized by industry and function so it’s easy to find something that suits your business’s needs. Being an online retailer can have some great advantages with little overhead costs and the ability to run business from pretty much anywhere. However, entering sales transactions and staying on top of the bookkeeping can take up precious time and resources. Fulfilling timely pay runs is crucial for a business, but can be stressful, especially when workforces are a mix of permanent, part-time and casual staff. Keeping track of frequent changes in rostered days and shifts can also be tricky.

Xero apps to help you be more productive on the go

The Insightly-Xero integration syncs contact details as well as sales opportunities while also tracking Xero invoices and bills. Sales staff can create new Xero invoice drafts in Insightly. No more valuable time wasted on cross referencing customer details and double entries, allowing faster sales lead times and chasing bigger deals.

A simple click directs your client to a secure payment page, branded with your company logo. To better illustrate how this new journey will work – meet Malia – a small business owner who has recently opened her own hair salon and manages her business day-to-day via Xero. With business starting to boom since the easing of COVID-19 restrictions, Malia has hired three new employees to help support her customer base of 100 regulars. She is now looking to expand her Xero experience with plug-in apps to manage timesheets, a new CRM and other payments.

- The Xero App Store is full of apps that save you admin time, improve the accuracy of financial tasks, and help you deliver better customer service.

- Easy-to-use accounting software, designed for your small business.

- Xero’s searchable app store makes solving business challenges simple.

- Tanda manages rostering, timesheets and pay rates of every staff member, freeing up business owners from menial administrative tasks.

- Full points are also earned on ATO, insurance, telco and utilities bills.

- To better illustrate how this new journey will work – meet Malia – a small business owner who has recently opened her own hair salon and manages her business day-to-day via Xero.

The new Xero App Store makes it possible to start a trial and securely purchase apps in just a few clicks, all using your single Xero login. And to make life even easier, you can manage all of those subscriptions in one place. When you’re ready to integrate apps with Xero, head to the Xero App Store to find what you’re looking for.

Any new app joining the Xero App Store will join on the new terms from today, while existing apps will have until 4 August 2022. No – Xero is based in the cloud, so all you need is an internet connection. But you need a multi-factor authentication (MFA) app to log in to Xero. MFA extra layer of security by checking that it’s really you when you log in. Schedule shifts, speed up payroll, and make managing your team more effortless with payroll and HR apps.

]]>Finally, you want to find a solution that you can customize if you have special reporting or processing needs. This may be relevant for larger companies that have multiple projects that they manage simultaneously and need to create comprehensive reports and cash flow data for stakeholders. Both plans allow you to track income and expenses, send invoices and accept payments and maximize your tax deductions with tagging features for expenses. The system also allows you to scan and organize receipts so that all project expenses are kept in one place. The reporting will enable you to track the profitability of each project so that you can stay ahead of costly mistakes. Bookkeeping for construction companies is based on construction contracts, which typically last longer compared to other industries since projects can take months or years to complete.

Implement Project Cost Tracking:

You can use construction invoice templates to bill your clients and keep a paper record of all construction projects and revenue generated. In this guide, we address some of those challenges and cover the basics of construction accounting. Follow this resource step-by-step to establish an effective accounting process, avoid costly mistakes, and make more money. Overall, using cloud-based solutions designed for construction, you can improve collaboration, reduce duplication of effort, and deliver your projects more efficiently. This can help you to stay competitive in the market, meet the growing demands of clients, and achieve your business goals more effectively. A cloud-based solution makes it easier to access your financial records because the information is stored on an external server.

of the Most Innovative Approaches in the Cleaning Industry to Watch For

Construction accounting also involves tracking revenues so that you can accurately measure the profitability of your projects. Construction accounting also includes the management of accounts receivable https://www.inkl.com/news/the-significance-of-construction-bookkeeping-for-streamlining-projects and accounts payable, cash flow, and the reporting of financial information. This article will introduce construction accounting, including the key principles and techniques for managing your construction business. Accurately tracking costs, revenues, and other financial data creates a foundation for companies to grow and stay cash flow positive. Given the unique financial challenges that construction businesses face, well-developed accounting processes are essential for executives to allocate financial resources efficiently.

- Construction accounting is an essential part of managing a construction business.

- All the factors above make predicting profitability extremely difficult in construction projects.

- In other words, laws on prevailing wage mandate that contractors pay a rate of compensation that’s not lower than the compensation determined for each worker classification or similar jobs in an area.

- When embarking on a project, it’s important to break down the costs into manageable categories to ensure the budget is well-managed.

Chart of Accounts

- Finally, you can use the information you get from a job profitability report to calculate key performance indicators (KPIs).

- However, managing your business finances correctly doesn’t always come naturally—especially if you’re not much of a numbers person.

- An accurate CIP report can enable construction firms to evaluate the financial performance of individual projects, mitigate challenges early on and ensure profit margins are met.

- The income statement shows the company’s revenue and expenses over a period of time, and the cash flow statement shows the inflows and outflows of cash during that period.

- Often called pay application or pay apps, the payment application report is a series of documents that contractors exchange with one another during payment.

That’s in contrast to how regular bookkeepers might handle workflows — at least for the most part. According to Statista’s research, it took approximately 15 months for a construction contractor to build a privately-owned residential building in the United States in construction bookkeeping 2021. Similarly, the US Census Bureau data reveals that nonresidential construction projects valued at over $10,000,000 take around 28 months to complete. The future of any construction company depends on how it keeps track of its spending. Fyle automatically categorizes expenses based on your accounting software’s chart of accounts, reducing errors and streamlining the approval process.

- Across the construction industry, average working capital turnover ranges from 5 to 15 depending on specialization.

- The Forbes Advisor Small Business team is committed to bringing you unbiased rankings and information with full editorial independence.

- Managing finances effectively is crucial for general contractors to ensure business success and long-term stability.

- Working capital turnover measures how much revenue each dollar of working capital is producing.

- The accrual method offers a more forward-looking view of a company’s finances by recognizing revenues and expenses as soon as bills are sent and received.

- Additionally, invoices provide necessary tax information for the client and contractor, allowing them to keep accurate records and file their taxes on time.

The next function layer is the Procore analytics feature that works with the specialized app marketplace filled with third-party solutions that integrate with Procore. To ensure compliance, construction companies should consider hiring a tax professional or a bookkeeper who is knowledgeable in tax laws. A tax professional can help construction companies identify tax deductions and credits that they may be eligible for, which can help reduce their tax liability.

Construction Accounting Best Practices

Using Hubstaff’s time tracking app for construction businesses, you can automatically generate time cards for your workers. This ensures payroll receives accurate data for the time workers spend on-site, as well as time spent traveling. With the completed contract method, you recognize revenue only after completing a project. Construction companies often use this method for short-term contracts, especially those where contract costs can be hard to estimate. Since construction accounting is project-centric, you’ll need a way to track, categorize, and report transactions for each job.

- Given the unique financial challenges that construction businesses face, well-developed accounting processes are essential for executives to allocate financial resources efficiently.

- This helps identify areas where costs are higher than expected, allowing for early intervention to prevent further overruns.

- Under regular business accounting circumstances, revenue recognition is simple because they sell a product or service and collect a fixed price right away.

- If not done correctly, contractors who operate in multiple jurisdictions can become subject to double taxation of their workforce.

- Additionally, you should regularly back up your data to prevent any loss of information due to technical issues or cyber-attacks.

- For example, corporations will have their equity broken down into investments, retained earnings, and net income.

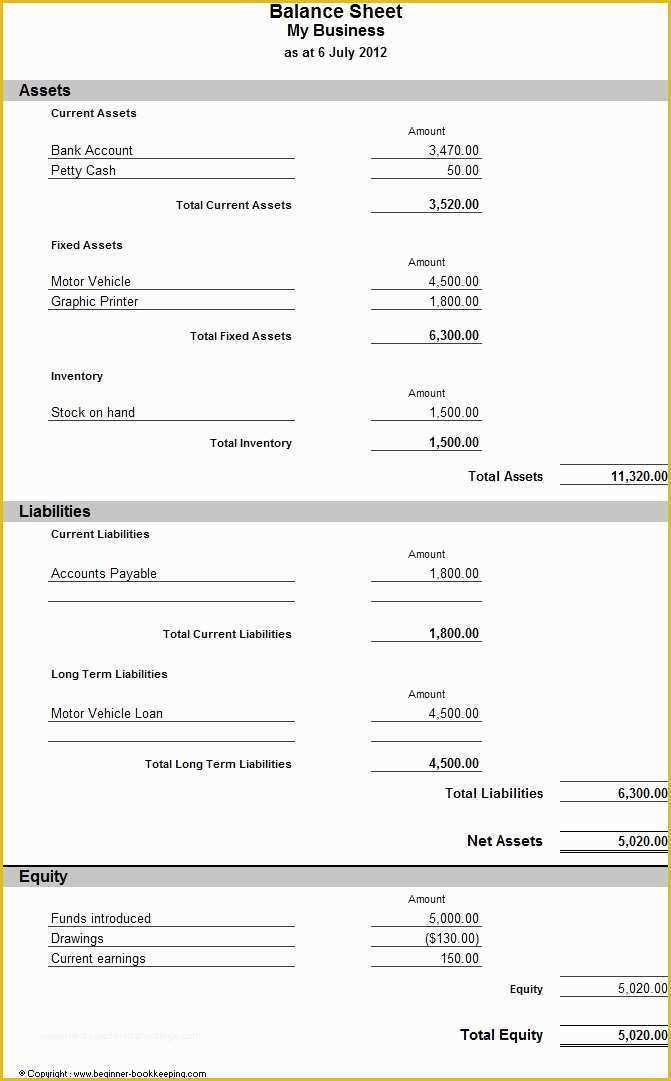

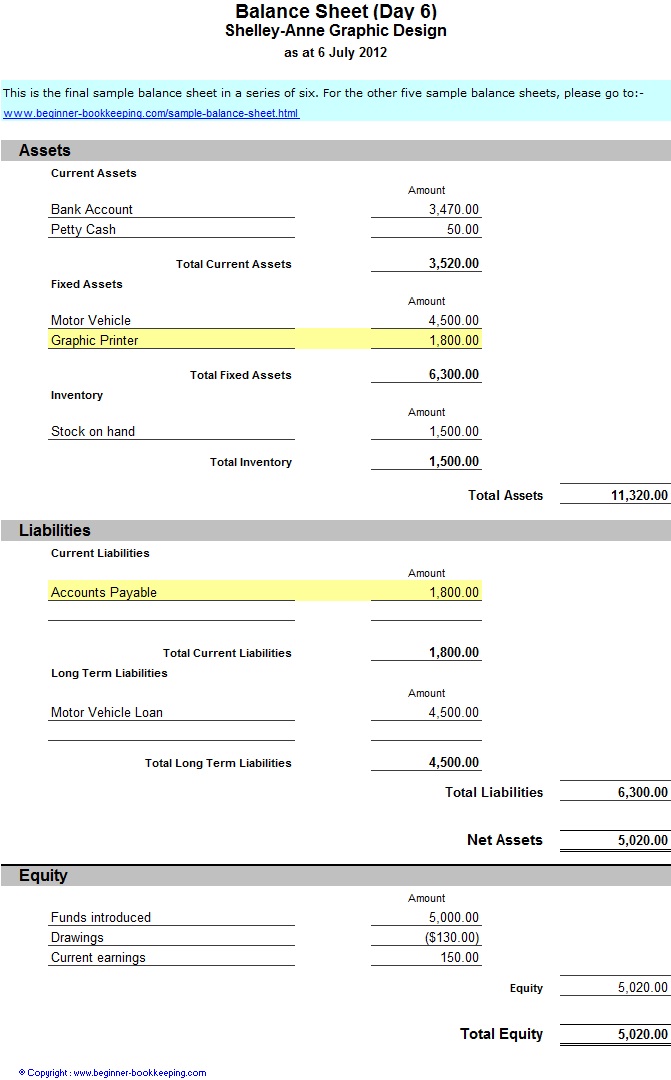

As you can see, the report format is a little bit easier to read and understand. Plus, this report form fits better on a standard sized piece of paper. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. A lender will usually require a balance sheet of the company in order to secure a business plan.

Create a Free Account and Ask Any Financial Question

Here’s an example to help you understand the information to include on your balance sheet. In the example below, we see that the balance sheet shows assets (such as cash and accounts receivable), liabilities (such as accounts payable, credit cards, and taxes payable), and equity. Total liabilities and equity are also added up at the bottom of the sheet—hence the term ‘bottom line’ for this number. Balance sheets can tell you a lot of information about your business, and help you plan strategically to make it more liquid, financially stable, and appealing to investors.

Add Total Liabilities to Total Shareholders’ Equity and Compare to Assets

Under shareholder’s equity, accounts are arranged in decreasing order of priority. An asset is something that the company owns and that is beneficial for the growth of the business. Assets can be classified based on convertibility, physical existence, and usage. QuickBooks Online users have year-round access to QuickBooks Live Assisted Bookkeepers who can give personalized answers to bookkeeping questions and help manage their finances. Schedule a free consultation to get pricing details and walk through the service.

- Financial position refers to how much resources are owned and controlled by a company (assets), and the claims against them (liabilities and capital).

- It is one of the three core financial statements (income statement and cash flow statement being the other two) used for evaluating the performance of a business.

- You can use this report to see how your business is doing overall and whether it has enough cash to cover its expenses.

- Now that we have seen some sample balance sheets, we will describe each section of the balance sheet in detail.

Example of a balance sheet using the report form

For instance, if a company takes out a ten-year, $8,000 loan from a bank, the assets of the company will increase by $8,000. Its liabilities will also increase by $8,000, balancing the two sides of the accounting equation. Long-term assets (or non-current assets), on the other hand, are things you don’t plan to convert to cash within a year. Calculating the change in assets on a company’s balance sheet is an important step when analyzing a business or stock. The direction of these changes can be indicative of a company’s health and future prospects.

What Is Included in the Balance Sheet?

We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources. Balance sheets also play an important role in securing funding from lenders and investors. For instance, accounts receivable should be continually assessed for impairment and adjusted to reveal potential uncollectible accounts. These ratios can yield insights into the operational efficiency of the company. It also yields information on how well a company can meet its obligations and how these obligations are leveraged. It uses formulas to obtain insights into a company and its operations.

Balance Sheets Are Subject to Several Professional Judgment Areas That Could Impact the Report

It is unsuitable for submitting to Companies House but will enable small businesses to produce a report for their year-end. If you are a limited company, you will need your accountant to format the report as part of your accounts to submit to Companies House. This ensures that the financial report adheres to the generally accepted accounting principles. To complete your balance sheet template you’ll need to add in details about the debts and liabilities your company owes. According to the equation, a company pays for what it owns (assets) by borrowing money as a service (liabilities) or taking from the shareholders or investors (equity). It’s important to note that how a balance sheet is formatted differs depending on where an organization is based.

The example above complies with International Financial Reporting Standards (IFRS), which companies outside the United States follow. In this balance sheet, accounts are listed from least liquid to most liquid (or how quickly they can be converted into cash). When the balance sheet is prepared, the liabilities section is presented first and the owners’ equity section is presented later. When a balance sheet is prepared, the current assets are listed first and non-current assets are listed later. Do you want to learn more about what’s behind the numbers on financial statements?

Balance sheets are typically prepared at the end of set periods (e.g., annually, every quarter). Public companies are required to have a periodic financial statement available to the public. On the other hand, private companies do not need to appeal to shareholders.

Balance sheets are important because they give a picture of your company’s financial standing. Before getting a business loan or meeting with potential investors, a company has to provide an up-to-date balance sheet. A potential investor or loan provider wants to see that the company is able to keep payments on time. According to the historical cost principle, all assets, with the exception of some intangible assets, are reported on the balance sheet at their purchase price. In other words, they are listed on the report for the same amount of money the company paid for them.

At a glance, you’ll know exactly how much money you’ve put in, or how much debt you’ve accumulated. Or you might compare current assets to current liabilities to make sure you’re able to meet upcoming payments. This financial statement lists everything a company owns and all of its debt. A company will be able to quickly assess whether it has borrowed too much money, whether the assets it owns are not liquid enough, or whether it has enough cash on hand to meet current demands. In short, the balance sheet is a financial statement that provides a snapshot of what a company owns and owes, as well as the amount invested by shareholders.

Balance sheets can be used with other important financial statements to conduct fundamental analysis or calculate financial ratios. Maintaining your business’s financial health is a key component of long-term success. Utilizing tools like the balance sheet and other how to do bank reconciliation financial statements will help you keep your finances in check. The balance sheet, income statement, and cash flow statement make up the three main financial statements that businesses use. Companies are required by law to generate these financial statements.

]]>Compile your income projections, expense estimates, and resource allocations into a draft budget. Use a spreadsheet or budgeting software to organize the information, making it easier to review and adjust as needed. Fixed costs are expenses that remain constant, such as rent or salaries, while variable costs fluctuate based on activity levels or other factors, such as utilities The Key Benefits of Accounting Services for Nonprofit Organizations or event expenses.

Estimate your nonprofit’s income

Capital grants are usually for large-scale items like construction, renovations, or equipment. A grant budget is one of the most important parts https://nerdbot.com/2025/06/10/the-key-benefits-of-accounting-services-for-nonprofit-organizations/ of your grant proposal. It doesn’t matter if you’re applying for a government, corporation, or foundation grant, a well-crafted budget will make or break your proposal. Regularly reviewing your budget helps your organization detect and address issues early on, make well-informed financial decisions, and build trust with stakeholders by reporting on your findings. Elizabeth Male is director of marketing and communication at StriveTogether.

The Ultimate Guide to Nonprofit Budgets + 3 FREE Templates

- The first essential element is revenue, which includes all anticipated income sources such as donations, grants, fundraising events, and program fees.

- Financial consultants or accountants with experience in nonprofit management can offer valuable insights into best practices for budgeting and financial reporting.

- This is also sometimes called a “broad scope budget” or an “annual budget” because it gives you a full picture of what the coming year should look like.

- This unpredictability can make it difficult to maintain a consistent income flow, leading to challenges in long-term planning and resource allocation.

- From a sample nonprofit budget template to comprehensive nonprofit annual budget templates, it covers all the essentials to keep your budget on track.

- More and more nonprofits are finding that cloud-based tools solve these issues, often incorporating templates and automated pathways that take a lot of the stress out of budgeting.

Once the budget has been reviewed and adjusted, present it to your organization’s board of directors for final approval. Ensure that all stakeholders understand the budget and are committed to adhering to it throughout the fiscal year. Set aside a portion of your budget for unforeseen expenses or emergencies. This fund will provide a financial safety net and allow your organization to respond to unexpected events without jeopardizing its financial stability. Are you looking for more resources to support your nonprofit organization? StriveTogether offers online training to help community leaders strengthen their work.

- Explore a range of nonprofit budget templates available for download to enhance your financial planning and ensure your organization’s sustainability.

- For each reporting period, the organization assesses its actual performance in comparison to the initial plan, ensuring progress and financial stability.

- The Relay Visa Debit Card is issued by Thread Bank, Member FDIC, pursuant to a license from Visa U.S.A. Inc. and may be used anywhere Visa cards are accepted.

- Some nonprofits identify every activity or grant as a separate program while others combine many activities under the umbrella term.

- Many nonprofits hesitate to reveal how much they spend on overhead costs with donors.

How to build your dream fundraising team (without the burnout)

Getting an idea of what these streams bring in will help you see how useful each of them are to your organization long-term. You might not be able to predict what your donors give, but you can control a lot when it comes to spending. 💸 If you’re feeling overwhelmed, try using your goals to prioritize expenses—and remember, you can always increase spending if you’re able to raise more revenue later in the year. Instead of predicting revenue by individual grants or line items, the cutoff method looks at revenue as a whole. To use this method, simply calculate the projected fundraising revenue by multiplying the estimated total amount with the probability estimate. Once you have your budget, compare the predicted numbers to the actual figures every month in order to look for differences and establish why they occurred.

- A nonprofit operating budget template can help you make sure you’ve hit all the bases.

- Therefore, it’s most effective to categorize the revenue side by source.

- Some funders may cap how much of the grant can be allocated to indirect costs (overhead or administrative expenses), with most placing this cap at around 15%.

- An operating budget is a budget that is used to cover basic day-to-day costs like materials, supplies, rent, utilities, etc.

- The main budget you’ll create is your operating budget, which details the costs you’ll incur and the revenue you’ll generate over the next year.

- Regularly scheduled budget reviews can facilitate this adaptability by allowing nonprofits to assess their current financial situation against external factors influencing their operations.

- If your nonprofit relies heavily on grant funding, this budget outlines program costs to meet grantor specifications, including fund-matching requirements.

- At this stage, it’s also important to assign roles to those involved in budget management.

- It should include some typical sources of revenue and expenses, which saves you time on listing everything out.

- Program-based financial information will be most useful for planning, management, and communications if it is comprehensive, accurate, and used consistently.

Personnel costs are the expenses related to compensating your nonprofit’s staff. Including personnel costs in your nonprofit budget template helps you plan ahead and keep finances under control. To help you through the budgeting process we’ll walk you through every line item you might need to include and show you how to create your own nonprofit organization budget template. Running a nonprofit is hard work, and an essential part of that is budgeting. Since we’re in the business of helping nonprofits, and creating the tools they need to do more good, we wanted to help by creating a sample nonprofit budget template that is free to download and use. The landscape in which nonprofits operate can change rapidly due to economic shifts, changes in funding availability, or emerging community needs.

Making a budget is a whole lot easier when you’re not relying on guesswork. One tip for goal-setting is to look beyond what you want for this year. Annual goals are absolutely necessary, but open yourself up to what could be possible five years from now. You’ll thank yourself later for having worked towards a long-term plan from the start.

This will also show you which funding sources are most reliable, especially true of recurring donations and multi-year grants. A popular methodology for this kind of planning is the S.M.A.R.T model, originally formulated for determining management goals. You can use a capital budget to ensure such initiatives have minimal impact on daily operations.

]]>